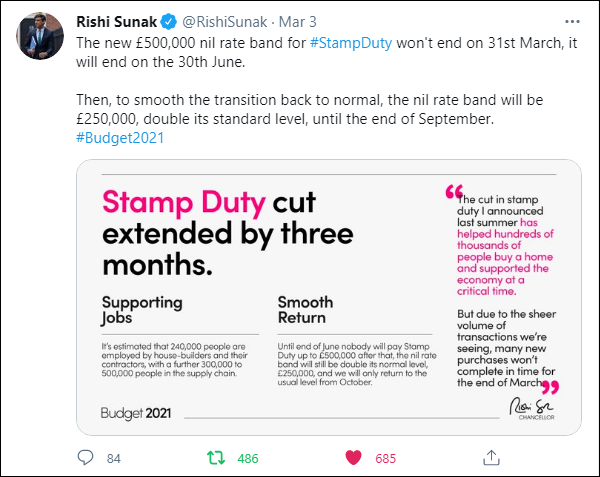

In a bid to keep the property market moving Chancellor Rishi Sunak has extended the stamp duty for a further 3 months.

This is welcomed by buyers and sellers as a huge relief as many were trying to beat the stamp duty deadline and according to Rightmove data, extending the scheme until the end of June could see an additional 300,000 sales in England and Northern Ireland.

For anyone having a property in the pipeline and for anyone that is thinking to sell this would now be another great time to jump onto the market and take advantage of the stamp duty holiday.

So what does the Stamp Duty Extension mean?

This is how the stamp duty extension will work:

Until 30th June: No stamp duty will be due on the first £500,000 of any primary residential property

1st July – 30th September: No stamp duty will be due on the first £250,000 of any primary residential property.

From 1st October: The stamp duty holiday will end on 30th September, meaning that normal stamp duty rates will apply from October onwards

In order for you to take advantage of the stamp duty, you will need to have completed your property purchase by the 30th September to benefit. If you exchange on or before the 30th September or complete after September then you will have missed the deadline and will need to pay the normal rate of stamp duty.

How much stamp duty does a first-time buyer pay?

Currently, first-time buyers across the UK are benefiting from the stamp duty holiday in the same way that other homebuyers are doing. This is what you would be currently paying as a first-time buyer

Until 30th June: First-time buyers in England and Northern Ireland will not pay stamp duty on the first £500,000 of a main residential property.

From 1st July until 30th September: No stamp duty for first-time buyers on the first £300,000 of a min residential property.

From 1st October: General stamp duty rates in England and Northern Ireland will revert to their pre-coronavirus rates, but there will be no change for first-time buyers, who will continue to pay no stamp duty on the first £300,000 of property (£300,000 was the pre-coronavirus stamp duty threshold for FTB’s).

When do I pay stamp duty?

In England and Northern Ireland once you have completed on a property you have 14 days to pay the stamp duty, legislation changed in March 2019 reducing it to 14 days to pay from 30 days.

The cost of stamp duty for some can also mean that the charges do on occasion have to be added to the mortgage loan value. To add the cost of stamp duty to a mortgage will also mean a larger debt and requesting to borrow more monies of which over a long term of a 25-year mortgage at a rate of 5% an extra £5,000 could end up costing £8,500 in interest.